Also known as the Great Crash, the Wall Street Crash of 1929 is considered the most devastating financial panic in the history of U.S. due to its duration and impact. It led to huge financial losses and the U.S. stock market was not able to recover from it for many years. Although it is not considered the sole cause of the Great Depression, it did play a role and accelerated the crisis. Know about the causes, the panic and the effects of this stock market crash though these 10 interesting facts.

#1 JUST BEFORE It, PEOPLE WERE INVESTING HEAVILY IN STOCKS

The decade following World War I was a period of boom in the U.S. due to post-war optimism and a drastic change in the lifestyle of Americans. It was marked by unprecedented consumerism with families being able to afford more than ever before and people buying goods on installment plans, which was a relatively new concept. People invested heavily in stocks and such was the positive sentiment that investors perhaps believed that the stock market would rise indefinitely and was a one way bet.

#2 OVER EXUBERANCE WAS A MAJOR REASON BEHIND It

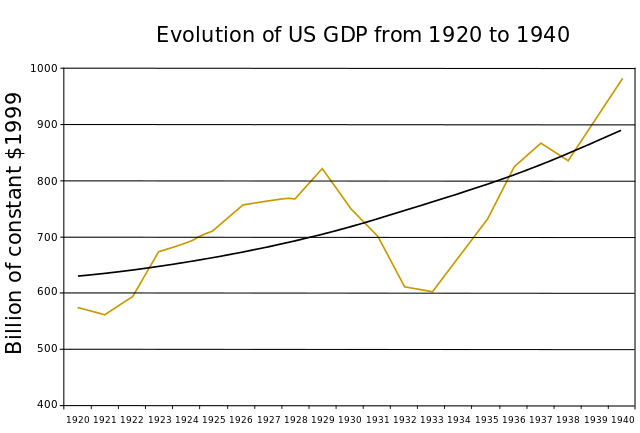

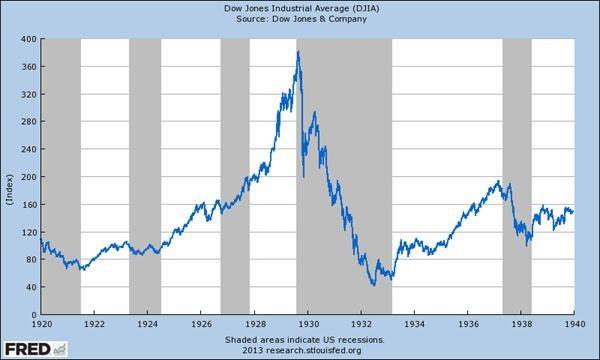

A major reason behind the crash was that share prices were not driven by economic fundamentals but by over exuberance and false expectation of the investors. The stock market was seen as an opportunity to earn big akin to the gold rush. By 1929, 2 out of every 5 dollars a bank loaned were used to purchase stocks. Share prices became much higher than their real value. The Dow Jones Industrial Average (a stock market index) increased 400% in the period between 1924 and 1929.

#3 AGRICULTURAL RECESSION ALSO CONTRIBUTED TO THE CRASH

Due to advancement in production techniques in the 1920s, there was a great rise in production in industries like automobile. But the demand didn’t rise proportionately and this led to many companies struggling to sell what they produced. Also with better technology there was an increase in supply of food but the demand couldn’t keep pace. Therefore, prices fell and farmers’ incomes dropped leading to widespread financial despair among American farmers. Disappointing profit results of companies and agricultural recession were major causes behind the crash.

#4 THERE WAS A MINI CRASH IN MARCH BEFORE THE WALL STREET CRASH IN OCTOBER

Speculation is the practice of engaging in risky financial transactions to profit from a fluctuating market. In March 1929, the Federal Reserve warned investors of excessive speculation. This led to a mini crash in the stock market exposing its shaky foundation. However Charles E. Mitchell announced that his company the National City Bank would provide $25 million in credit to stop the market’s slide. The mini-panic was overcome and on September 3, 1929, the Dow peaked at 381.7 points.

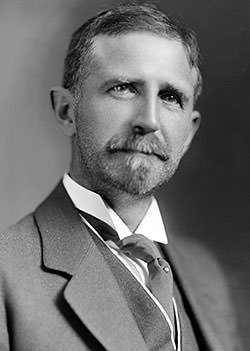

#5 ECONOMIST ROGER BABSON PREDICTED THE CRASH ABOUT A MONTH AGO

On September 5, 1929 economist Roger Babson gave a warning ‘Sooner or later, a crash is coming, and it may be terrific’. He had predicted a crash several times before but this time it really happened. Over the next few weeks the prices began to move downward. In the last hour of trading on October 23, the stock prices began to fall sharply. People were taken by surprise and panic set in. The next day, known as Black Thursday, saw prices drop drastically. Newspapers reported losses as high as $5billion. The following day President Herbert Hoover reassured Americans that business was sound.

#6 THE DOW DROPPED A RECORD 13% ON BLACK MONDAY

Despite bankers pouring money into the market and newspapers reporting that brokers felt that the worst was over, the market went into a free fall as soon as the opening bell rang on October 28 (‘Black Monday’). By the end of the day, the Dow had dropped a record 38.33 points or 13%. So many Shares changed hands that traders had to work till late night to record them all and be ready for October 29.

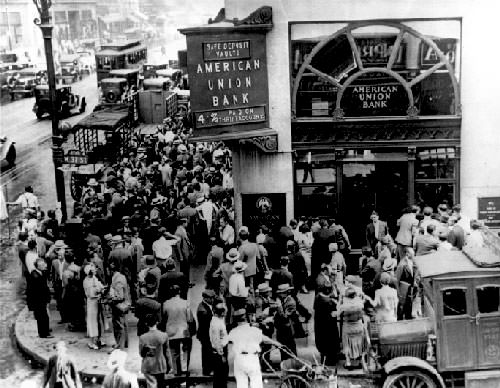

#7 BLACK TUESDAY’S RECORD OF 16.4 MILLION SHARES BEING TRADED LASTED FOR NEARLY 40 YEARS

It is said that on October 29 (‘Black Tuesday’), the opening bell was never heard due to the shouts of “Sell! Sell! Sell!” 16.4 million Shares were traded on the day as panic selling reached its crescendo. Trades happened so quickly that people couldn’t calculate how much money they had lost. Many investors lost their life savings in an instant. There were fistfights and false rumors of investors jumping from building further accelerating the market slide. The volume of stocks traded on October 29, 1929 was a record that was not broken for nearly 40 years. By the end of the day the Dow fell further by 12%.

#8 THE U.S. STOCK MARKET WAS NOT ABLE TO RECOVER FOR MANY YEARS

$25 billion (more than $300 billion in today’s money) was lost in the Wall Street Crash of 1929. Despite efforts from America’s financial elite, the market kept sliding barring minor reliefs. There was another longer steady slide from April 1931 to July 8, 1932, when it reached its lowest point at 41.22, down 89% from its peak. The stock market was not able to reach its pre-crash numbers until 1954, 25 years after the crash of 1929.

#9 IT IS CONSIDERED THE STARTING POINT OF THE GREAT DEPRESSION

The Wall Street Crash of 1929 became worldwide news and marked the beginning of the Great Depression of the 1930s which affected not only the U.S. but many countries around the world. Unemployment in America went from 1.5 million in 1929 to 12.8 million in 1933. Around 25% of the workforce was unemployed. And the trend was similar across the globe. Some economies started to recover in the mid-1930s but most countries including the United States were not pulled out of the Depression till the advent of the Second World War in 1939, in which tens of millions of people were employed to defend their countries.

#10 IT IS CONSIDERED THE MOST DEVASTATING FINANCIAL PANIC IN THE UNITED STATES

Though there have been other crashes with bigger numbers and fallouts, the Wall Street Crash of 1929 is considered the most devastating financial panic in the history of U.S. due to its duration and impact. Economists still debate over the impact of the Wall Street Crash on the Great Depression but it is generally agreed that though it was not the sole cause of the Depression, it did accelerate the global economic collapse. It was believed by many that the crash was caused by commercial banks that were too eager to put deposits at risk on the stock market. In 1933 the Glass–Steagall Act was passed by U.S. congress that mandated a separation between commercial and investment banks.

LARGEST ONE-DAY CRASH IN THE U.S. STOCK MARKET

On Monday, October 19, 1987, the stock markets around the world crashed. Known as Black Monday, the crash began in Hong Kong and hit U.S. after other markets had already declined significantly. The Dow Jones Industrial Average (DJIA) fell exactly 508 points from 2246.74 to 1,738.74 (22.61%). This was, and as of October 2015 remains, the largest one-day percentage decline in the DJIA. The 1987 crash was however not so devastating and in less than 2 years the market reached its pre-crash levels.